Last month, Massey University Fin-Ed Centre published its latest annual Retirement Expenditure Guidelines.

Each year, this report provides an overview of New Zealand retirees’ spending levels relative to NZ Superannuation payments. And once again, data shows that living costs continue to exceed NZ Super - with high inflation now widening the gap even faster.

If you’re planning to enjoy your future retirement in New Zealand, this is a timely reminder of the importance of having a plan in place. The earlier you start planning, the more options you will have to achieve your goals. So, here’s what Massey’s report highlights.

NZ Super not keeping up with rising cost-of-living

One of the key findings is that, while NZ Super increased 5.95% this year, that’s not enough to keep up with inflation.

The Consumers Price Index was up 7.3% in the year to June 2022 - the highest increase in at least 32 years. And as a result, the pension gap keeps widening for most New Zealand retired households, regardless of where they live or how comfortable their retirement lifestyle may be.

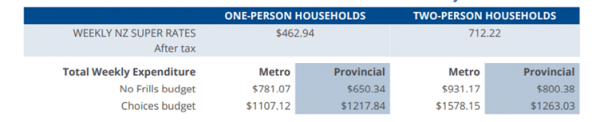

Source: Massey Fin-Ed Centre, NZ Retirement Expenditure Guidelines 2022

As data shows, NZ Super alone is not nearly enough to support retirees’ standard of living in full. This means that people need to tap into other sources of income and savings to fund their ‘golden years’ - which becomes all the more challenging in the current inflationary economy.

How to close the pension gap

Source: Massey Fin-Ed Centre, NZ Retirement Expenditure Guidelines 2022

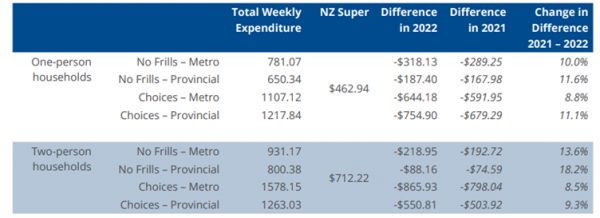

In 2022, the difference between NZ Superannuation and weekly expenditure increased significantly for all retired household groups. The increase in dollar terms ranges from $13.57 per week (two-person households, no frills - provincial) to $75.61 (one-person household choices - provincial).

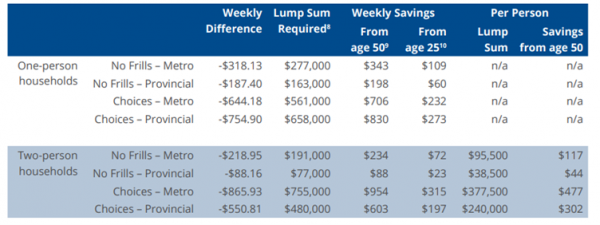

Source: Massey Fin-Ed Centre, NZ Retirement Expenditure Guidelines 2022

Put simply, people require a bigger lump sum to fund this additional spending. And as the table above shows, the earlier they start, the less they need to put aside weekly for their retirement.

So, if you’re looking for ways to make your retirement savings go the distance, saving more regularly is one. Another key step - if you have more than 10 years until retirement and your attitude to risk allows it - is to choose a higher-risk investment fund. It will experience wider short-term fluctuations in value, but over time, it’s more likely to deliver higher returns than its conservative counterparts.

You may also consider delaying your retirement and continue working for a few more years past age 65, either in a full-time or part-time capacity. This should allow you to put some extra money into your nest egg.

Will inflation continue at the same pace?

It’s too early to tell at this stage. As Massey’s report noted, the Reserve Bank of NZ is focusing on bringing inflation near the 2% point by increasing the Official Cash Rate - and the battle is far from over. The outcome will depend on labour market trends, supply chain disruptions, and energy prices.

That said, it would be surprising if high inflation disappeared overnight. What we do know is that it creates extra challenges for retired households, especially those relying on the fixed income provided by NZ Super. The risk is that inflation erodes the value of savings.

So, how can you manage inflation in your financial life and investment journey? Here are some suggestions:

- Review your expenditure on a regular basis;

- Check where your money is invested;

- Consider diversifying your income streams: for example, holding your retirement savings in cash can reduce volatility, but it also makes them more vulnerable to inflation.

These are just a few examples of steps to consider, but there may be others depending on your circumstances. Get in touch if you’d like to discuss your needs.

Do you have any questions for us?

Saving for retirement is a long-term endeavour, and inflation represents one of the biggest challenges you’ll encounter along the way. That’s why having a plan is so important, and as financial advisers, we’re here to help.

If you have any questions, click here to contact us or give us a call on 0800 UK 11 NZ. We’re investment and UK Pension transfers experts.

Disclaimer: Please note that the content provided in this article is intended as an overview and as general information only. While care is taken to ensure accuracy and reliability, the information provided is subject to continuous change and may not reflect current developments or address your situation. Before making any decisions based on the information provided in this article, please use your discretion and seek independent guidance. Past fund performance is no guarantee of future returns.